Our “Green Fintech 2.0: Next Generation Climate and Environmental Analytics to Accelerate Green Finance” report is the first of its kind to explore the current landscape and evolution of green fintech analytics companies in the UK.

Building on our database of 200 UK-based green fintech businesses, we present an overview of the most popular product categories, funding received, growth stage, regional distribution, notable acquisitions and more.

Credible and transparent analytics, based on robust science, provide the foundation for financial markets to price climate, nature and wider environmental risks effectively and (re)allocate capital accordingly.

The UK offers the perfect conditions to deliver the necessary innovation in this space. We have a world leading research and science base developing talent all around the country. We host one of the most important global financial hubs. And we have one of the most progressive green finance policy environments in the world.

Key takeaways

- Regulatory requirements and maturing data capabilities of financial institutions fuel growing demand for ESG data and analytics. While evolutions in climate and environmental data collection, processing and modelling underpin new green fintech solutions.

- Green Fintech 2.0 leverages 3rd party climate and environmental datasets to complement corporate disclosures. Empowering investors and their sustainability ambitions with independent analysis.

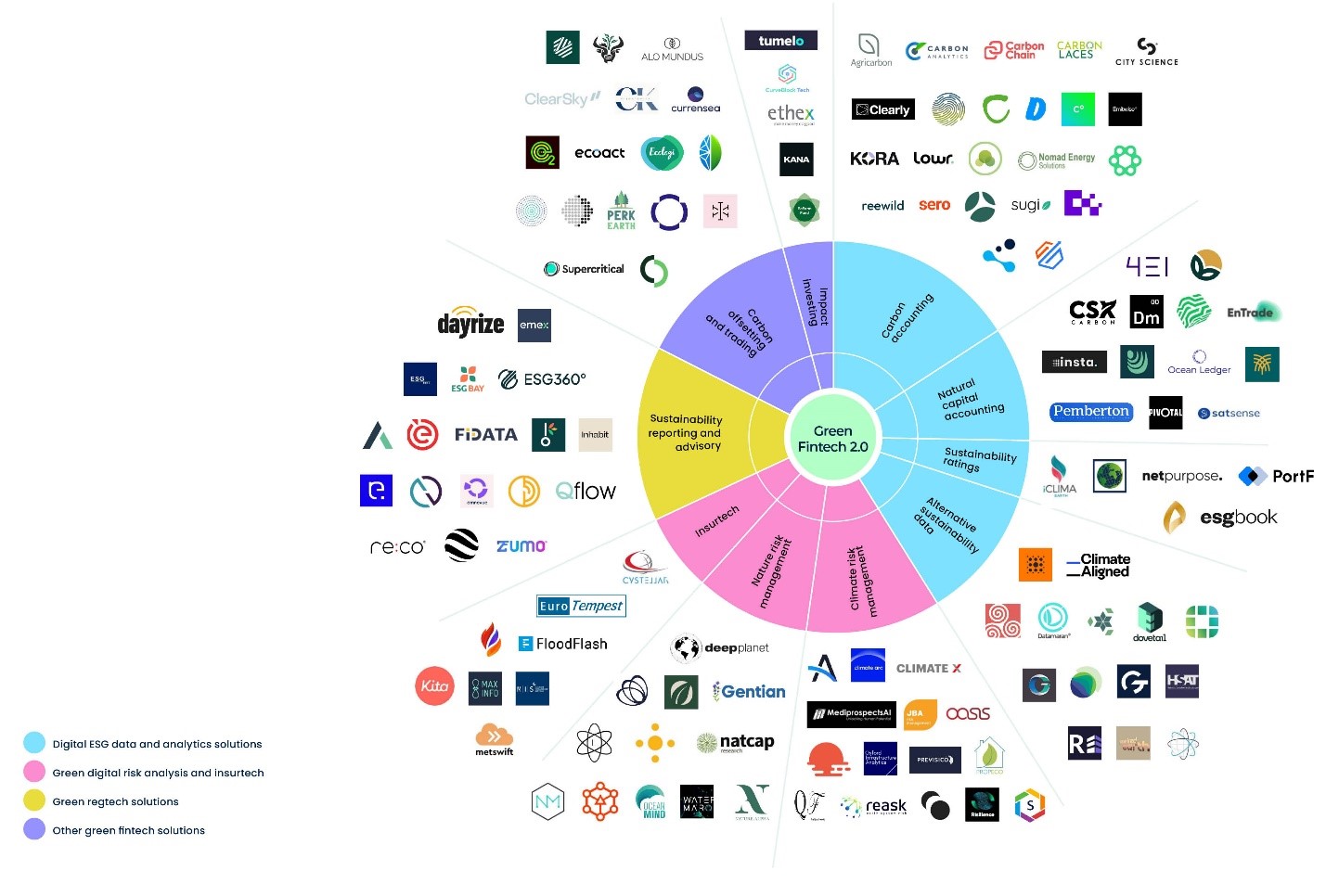

- The UK is home to a vibrant ecosystem (below) of green fintech businesses, offering solutions mainly in carbon accounting, sustainability reporting and advisory and climate risk management.

- We have identified £632m of investment in UK-based green fintech companies, offering solutions mainly in sustainability reporting and carbon offsetting and trading.

- Growing VC investment in green fintech, collaborative regional clusters and specialist accelerator programmes around the UK are the foundations for further growth.

Download the report here to explore some of the exciting opportunities at the intersection of financial technology and climate and environmental data:

- Understand trends in demand and supply of green fintech and foundations for growth.

- Discover the classification of green fintech product categories.

- Deep dive into the thriving early-stage startup ecosystem in the UK.

- See investment data and funding growth.

- Learn about CGFI’s innovation thesis and how we want to grow this ecosystem further

If this resonates with you or you’d like to find out more, please get in touch with Janak Padhiar to explore further opportunities.

We launched the Green Fintech 2.0 report at Scale Space White City in London on Thursday 11th July. Click below for insights from the event, including our panel with investors, incubators and green fintech companies on how we can accelerate innovation in this space even further and faster.