In December 2024 we ran a webinar series in partnership with Nature Tech Collective and Innovate UK Business Connect to explore and discuss the latest trends in green fintech with colleagues from the world of fintech, venture capital, financial institutions and other experts. This blog captures some of the key insights and takeaways from those sessions.

Nature fintech drivers and demand

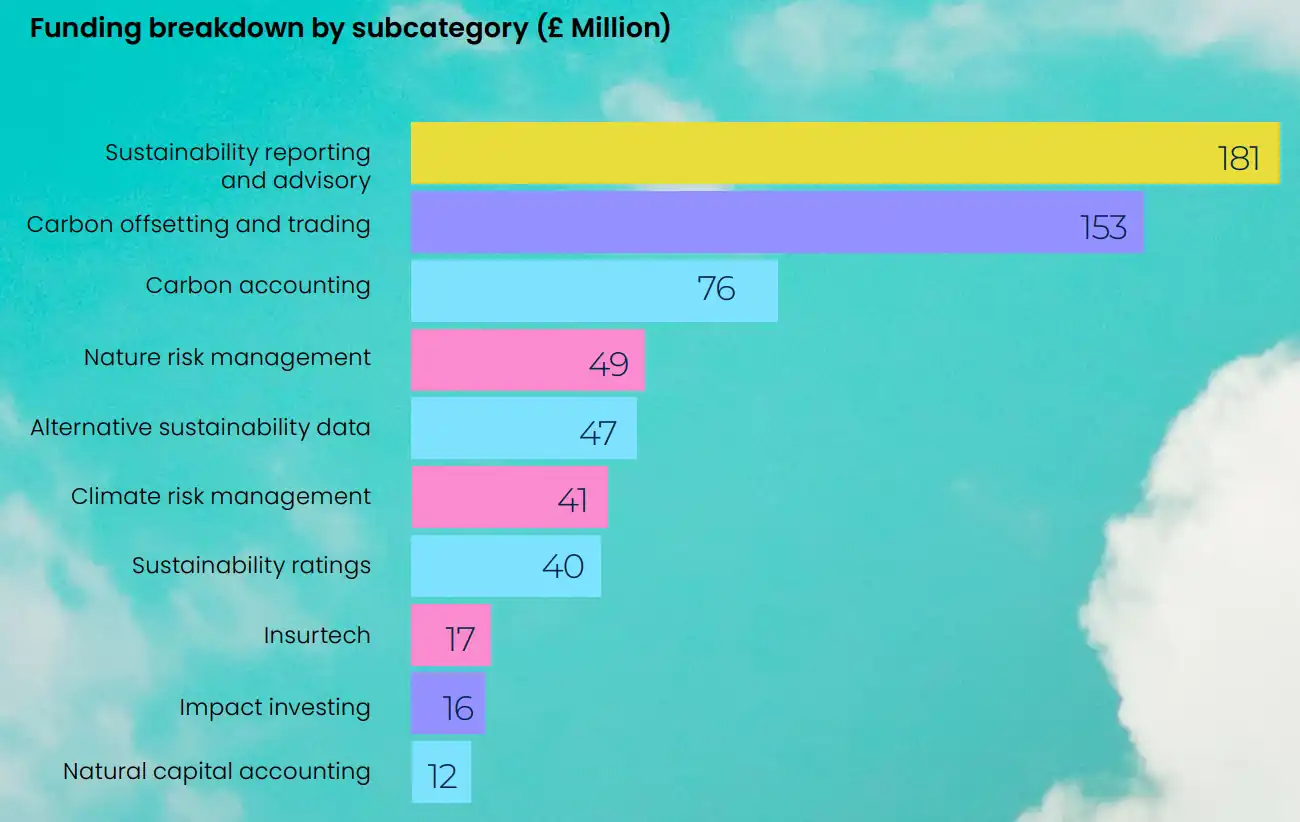

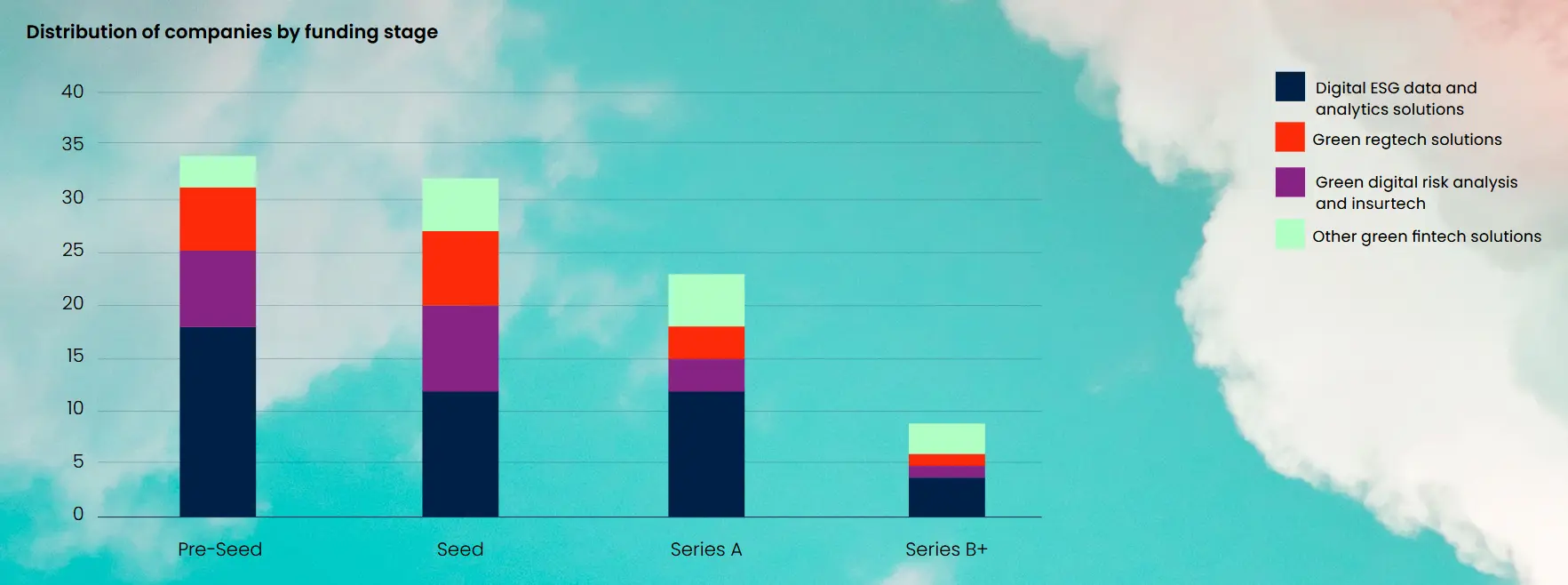

Green and nature fintech is growing rapidly in the UK with over £630M in investment supporting fintechs in carbon accounting, sustainability reporting, climate risk management and more. The private sector is rapidly taking up nature-focused tech solutions.

Financial reporting requirements and regulations are significant drivers. For example, the EU’s CSRD requires companies to assess and disclose nature-related risks. The complexity of nature risks means standardised metrics and reliable data are sorely needed.

Demand is also driven by profitability considerations. Nature risk is connected to business bottom lines. Sectors like mining and agriculture, with direct nature dependencies, are early nature fintech adopters. Where companies lack internal capacity for climate and nature risk analysis, they require third party solutions.

In general, financial institutions and corporates are also conscious of maintaining their sustainability leadership. A focus on climate in sustainability is expanding to recognise the importance of tackling nature and biodiversity risks – but capacity and action are lagging.

The role of capital providers and innovators

Innovation, both financial and technological, is the key to accelerating nature fintech solutions. There is tremendous potential to scale green fintech further by unlocking capital, applying data in industry, and fostering innovation. Venture capital is crucial to supporting startups, while financial institutions can act as market makers and connect businesses to nature-based finance. Green fintech itself can help overcome barriers to sector investment.

For venture capital, the need to de-risk investments can be a barrier to scaling new solutions, with an added challenge that the greatest nature risks are often in higher-risk emerging markets. But capacity building for science-based data/analytics could help de-risk larger projects and unlock capital to scale earlier stage solutions. VCs are already interested in biodiversity-focused fintech, but there needs to be an ambitious push for investment, rather than relying on regulation.

For financial institutions, debt structures are currently challenging for businesses focusing on nature and biodiversity because of short-term cash flow issues; direct financing of nature-based assets could offer a solution. FIs have the potential to serve as market makers and connect businesses to nature-focused investments. Improvements in natural capital, geospatial data, and customer targeting could unlock and mainstream nature-based solutions and products – such as discounted mortgage rates based on businesses taking nature-based actions.

Data providers, startups and fintech businesses looking to scale can maintain transparency and collaborate with financial institutions to integrate ecosystem services into decision-making processes. Collaborations can help add value to their data by tailoring solutions to industry use cases or integrating financial aspects like monetisation.

How can policy and academia support nature fintech?

Policy and regulation are driving green/nature fintech uptake by requiring companies to disclose nature-related risks. A continued push from regulation can help scale nature fintech solutions globally.

At COP29, in relation to fintech, progress in carbon markets under Article 6 has supported some renewable energy financing. Loss-and-damage assessment increasingly leverages data and tech, while blended finance to de-risk investments and mobilise private capital is becoming more prominent. From the perspective of data/analytics providers, COPs are becoming less relevant as a venue for startup-client conversations.

Academia also plays an important role in the ecosystem. We need to connect academic research with financial institutions and regulators to improve decisionmaking and practice in other sectors, especially for complex nature risks.

Researchers’ work and expertise can tackle data gaps; evaluate evidence, impact and best practices; and create novel tools, methods and insights that are essential to innovation in business. Academia itself also needs support to deliver qualifications and graduates who can meet the skills gap in this niche, and equip future business leaders with tools for integrating nature into governance and practice.

Priorities for collaboration

Four areas for collaboration were highlighted by the webinar participants:

1.

Identifying best practice around incentives for investors and lenders .

2.

Providing a platform for nature tech startups to connect with large companies with nature agendas .

3.

Educating end users, providing frameworks and tools on how to integrate nature insights into practice.

4.

Undertaking research around the effectiveness of nature tech solutions for business operations, provide evidence to improve practices.

In 2025 we’ll release further analysis on green fintech in Europe. To help us shape this work, or to engage with innovators in the CGFI network, follow us on LinkedIn or sign up to our mailing list.

Four areas for collaboration were highlighted by the webinar participants: