8th May Event| Building Societies Annual Conference, Manchester

Breakout session: How well do you understand the impact of climate change on risk management?

The UK Centre for Greening Finance and Investment (CGFI) Leeds Innovation Hub hosted a breakout session at the Building Societies Annual Conference.

The session brought together industry experts and academics to discuss the challenges posed by physical climate change to the building society sector, with speakers:

- Paul Broadhead – Head of Mortgaging Policy, Building Society Association (BSA)

- Prof Iain Clacher – Leeds University Business School, University of Leeds (UK CGFI)

- Prof Jason Lowe OBE – Priestley Centre for Climate Futures, University of Leeds and Met Office

Key findings

Key findings included a focus on risk assessments, and regulatory adaptations to address climate impacts. The session underscored the importance of proactive measures, stakeholder engagement, and collective action in tackling the complex challenges posed by climate change.

The BSA conference provided a platform for stakeholders to exchange insights, identify challenges, and explore collaborative solutions to address climate risk in the building society sector. Discussions delved into climate risk analysis, strategic resilience measures, and integrating climate data into planning.

Introduction

The session began with Paul Broadhead highlighting the importance of understanding and managing physical climate risks for building societies. He stressed the need for collaboration, data-driven insights, and targeted mitigation strategies to address these risks effectively.

Following Broadhead’s remarks, Professor Iain Clacher discussed the planned collaborative efforts between UK CGFI Leeds and the BSA to translate climate science into actionable insights for the building society sector and associated financial sector. He emphasised the importance of bridging the gap between academia and industry to address shared challenges and capitalise on commercial opportunities. Iain also outlined the objectives of the collaborative project, including raising awareness, building capacity, promoting resilience, and facilitating collaboration among stakeholders.

Next, Professor Jason Lowe OBE provided insights into climate change trends and projections over the UK, emphasising the urgency of addressing global warming. He highlighted the increasing frequency of extreme weather events, rising sea levels, and the need for mitigation and adaptation strategies. Jason also discussed the UK Climate Projections dataset, which provides guidance on future climate risks and impacts. Additionally, he highlighted the climate risk explorer tools produced through UK CGFI’s research.

Working group discussions

Following the speaker presentations, the session transitioned into facilitated small working group discussions. The format allowed for diverse perspectives to be shared and captured, with the aim of informing the BSA – UK CGFI Leeds collaborative project.

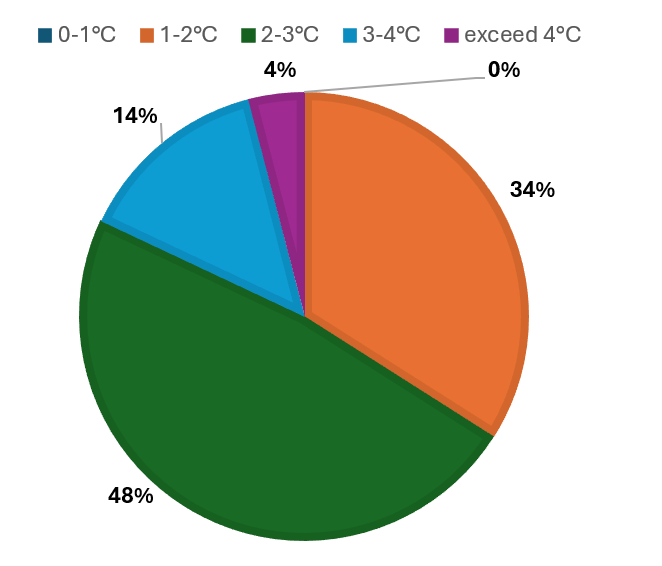

Discussions began with a poll, inviting everyone to share their perspective on the projected temperature increase in the UK over the next 50 years (relative to now).

The majority (48%) anticipated a temperature increase of 2 to 3 degrees Celsius, followed by 34% predicting a rise of 1 to 2 degrees Celsius.

14% suggested a warming of 3 to 4 degrees Celsius, while only 4% of responses foresaw a temperature increase exceeding 4 degrees Celsius. No participants estimated a temperature rise within the range of 0 to 1 degree Celsius.

Participants then engaged in discussions around four key questions related to climate risk analysis and decision-making within the sector.

Impact of extreme weather events

Can you share examples of how extreme weather has affected your assets or operations – immediate and long-term consequences?

Participants noted that such events led to financial strain on borrowers and hindered access to flood insurance, exacerbating arrears and credit loss. Additionally, recurring branch flooding incurred immediate costs for remediation and caused long-term disruptions to operations. Concerns emerged regarding the viability of lending against flood-prone properties, potentially resulting in stranded assets and uncertainties in property valuations.

Planning for extreme weather events

What strategic considerations or technologies has your organisation adopted for resilience against extreme weather now?

The top findings regarding resilience against extreme weather include a shift to renewable energy sources like solar panels and green electricity supply, adoption of electric vehicles (EVs) and charging infrastructure, and emphasis on risk assessment and adaptation strategies such as individual property risk assessments and revised lending policies.

Major Climate Change Considerations

What major climate-related changes do you foresee impacting your sector (and over what timescale), and how are you preparing for this?

Three key findings emerged. Firstly, there’s a recognised need for assistance in climate mitigation and adaptation. Secondly, there’s a growing concern about building resilience against increased hazards like floods, wind, and heat, with implications for insurance, asset values, and affordability. Lastly, regulatory changes and retrofitting measures are seen as crucial in addressing climate-related challenges, underscoring the importance of government intervention and infrastructure development.

Sources for Climate Change Risk Information:

How does your organisation obtain and integrate climate risk information into operational or strategic planning?

Organisations utilise various sources such as consulting firms like PWC and KPMG, as well as academic partnerships with institutions, to gather relevant data. Secondly, there is a focus on third-party specialists and data providers for portfolio analysis, property assessments, and geographic risk evaluations, highlighting the reliance on external expertise. Lastly, there is an emphasis on incorporating climate risk into risk policy frameworks, annual reviews, and strategic planning processes, underscoring the importance of integrating climate considerations into overall risk management strategies.

Q&A

During the Q&A session, participants raised questions about engaging with technology firms, influencing public policy, and addressing bottom-up change. The speakers emphasised the importance of collaboration, data sharing, and tailoring messages to different audiences. They highlighted the need for multi-stakeholder engagement and recognising the co-benefits of climate action.

Key messages

Paul Broadhead emphasised the importance of understanding and managing physical climate risks for building societies. He stressed the need for collaboration, data-driven insights, and targeted mitigation strategies to address climate risks effectively.

Professor Iain Clacher discussed the collaborative efforts between CGFI and BSA to translate climate science into actionable insights for the financial sector. He highlighted the objectives of the collaborative project, including raising awareness, building capacity, promoting resilience, and facilitating collaboration among stakeholders.

Professor Jason Lowe provided insights into climate change trends and projections, emphasising the urgency of addressing global warming. He highlighted the increasing frequency of extreme weather events, rising sea levels, and the need for mitigation and adaptation strategies. He also highlighted risk exploration tools developed by UK CGFI

Next steps

Findings and diverse perspectives captured during the session, will be presented at the next BSA Property Risk Panel meeting. Findings will also feed into the BSA – UK CGFI Leeds collaborative project.

BSA will keep it members informed, via its communication channels, on the project’s progress.

UK CGFI aims to present the project findings at the next Building Societies Annual Conference, in 2025.

Sign up to our UK CGFI Leeds mailing list to receive our research updates, invitation to future events, and opportunities to collaborate.